More and more food and beverage consumer packaged goods (CPG) discovery and commerce is happening online. CPG brands who want to get ahead of the competition use e-commerce activity in different ways to jumpstart their retail strategy.

Consumers discover products online

Undoubtedly, a utopia for many CPG manufacturers is seeing their products go into shopping carts and out the checkout aisle. Successful brands in national retail distribution know this journey can take more than a decade – if they make it at all. Ninety five percent of new products fail, according to INC.

While the COVID-19 pandemic has shown an upswing in online grocery sales, the majority of food is still bought in retail stores. At a retailer point of sale, brands will grow and gain maximum consumer awareness.

Yet, retailers – faced with challenges of limited shelf space and the pressure of stocking high velocity goods – will need to rely on brands to bring in customers to their stores and increase product sell-through. Additionally, the average grocery store carries ~30,000 SKUs, according to FMI data*. Therein lies a great responsibility on brands to have some consumer recognition once they hit the shelf.

Curious to learn more on how to increase sales when your products land on the shelf? Watch our business workshop, “Building Profitable and Powerful Promotions” here.

Fortunately, consumers have many ways of discovering new products online, which can really help new brands make noise. Instagram and Tik Tok are obvious platforms for customers to explore new products, but there are others with a more specialty focus.

Some alternative online sales channels promoting trial include SnackMagic (sister brand to CPGPulse), which specialize in employer-sponsored custom gift boxes that allow consumers to order a variety of single products from different brands.

Sampling platforms, like SocialNature’s product launchpad, focus on getting innovative natural products on shelves with the help of consumer ratings and reviews.

Wholesale marketplaces such as RangeMe serve a small, independent retailer audience. This group of retailers (known as ‘brand-builders’) have lower barriers to entry and tend to be early adopters of emerging brands. These brand builders help brands build awareness to get on the radar of larger store chains. The more points of distribution, and consumer traction, the more authorizations.

Data, data, data

The other great thing about selling online is your ability to collect first-party data to help steer your growth strategy in partner channels. While industry-standard data platforms translate retailer point-of-sale data, the additional benefit of first-party e-commerce data is that brands can often use this data to reach out to customers directly, and ask them for any feedback loops.

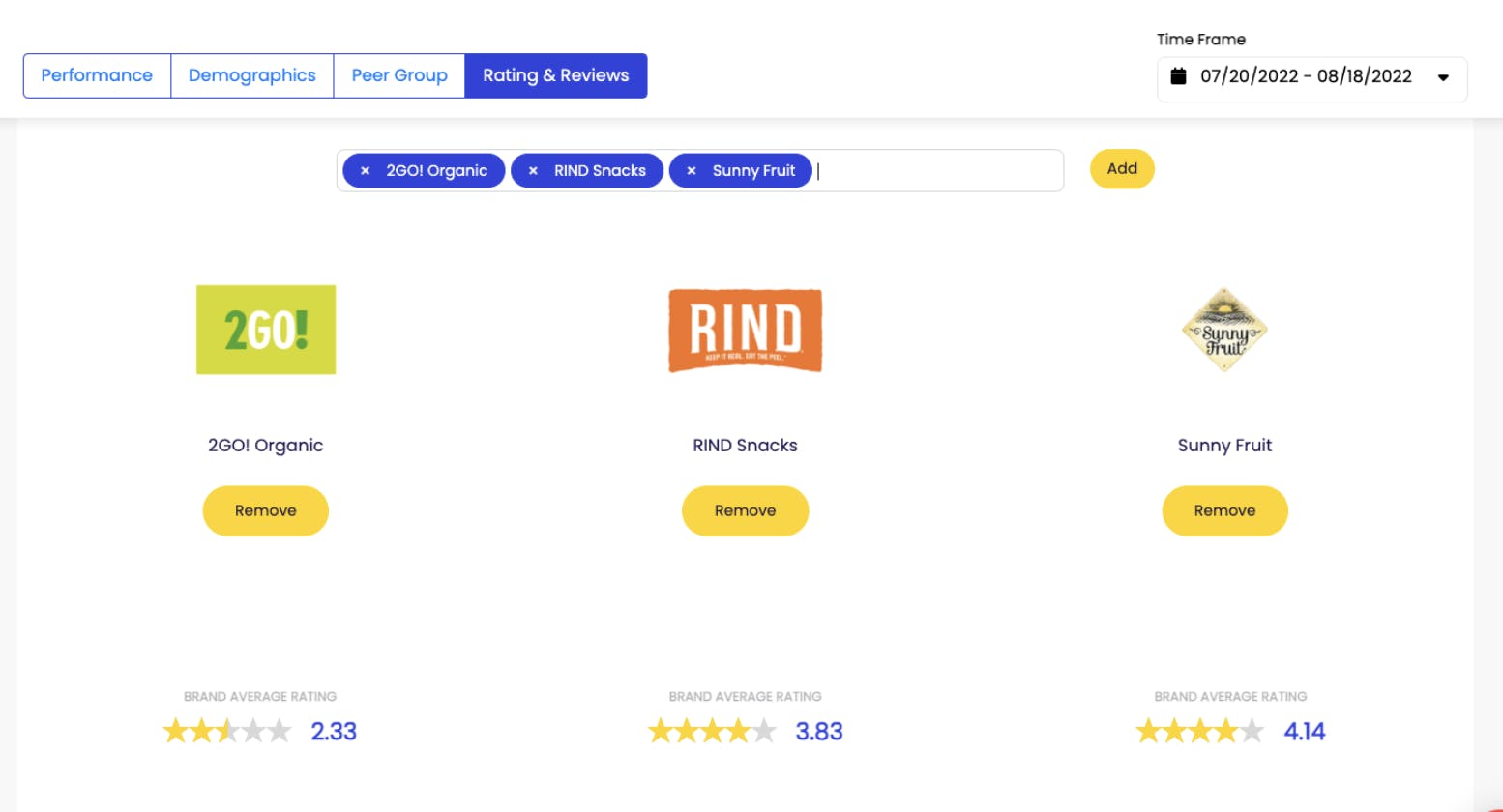

Consumer ratings and reviews can be a great source of truth to help brands reconfigure formulations, re-do packaging, and sunset certain flavors. Online ratings and reviews on public forums are also a great resource for retail buyers to understand growth and reception of certain brands and products.

E-commerce platforms like Shopify, provide analytics around top search store results (as long as you have a search bar) which can give insights into key trends consumers seek.

Last but not least, selling online allows brands to see where customers are coming from – unveiling basic demographic information such as household income, age, and gender, so you can obtain new learnings about your audience – or confirm what you already know for targeting efforts. These insights help inform geomarketing advertising strategies and identify new retail opportunities based on where consumers order products to their homes.

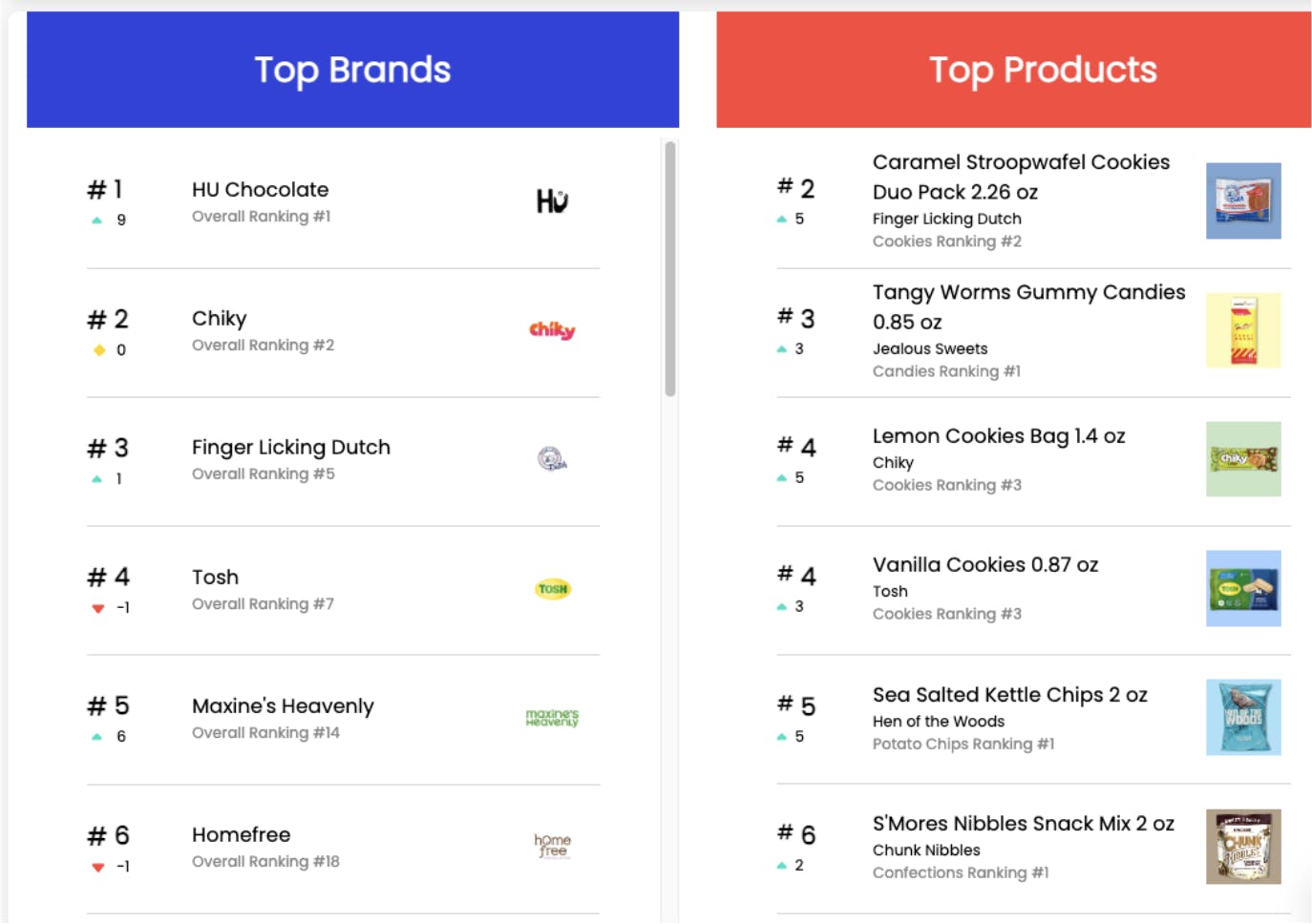

Platforms, such as CPGPulse which is the official first-party data platform for SnackMagic, consolidates various online data points for emerging brands and serves as an index for the community, since SnackMagic prioritizes stocking emerging brands that are often in between a solely direct to consumer (DTC) business and going into retail.

On Pulse, brands will see quantitative data such as unit velocity, purchaser demographics, brand comparisons (to compare data against others in similar product sets), basket analysis (what else people are buying with your products, to help with product collaborations or competitive analysis), and consumer ratings and reviews. Whether or not you are in the SnackMagic network, you can create a limited-time free account, log in, and can verify similar brands with a shared audience to get insights and learnings.

Additionally, the platform hosts investor/buyer dashboards specific for retail buyers and other merchandisers to spot category, brand, and product trends with a brand universe that commands a great deal of consumer cache.

Experimentation, before the stakes get too high

Selling goods online allows brands to experiment, make mistakes, and learn quickly. Quick experiments are not as easily conducted in-store due to the scale and complexity of the supply chain to get on shelf. Once authorized, retailers are beyond testing a ‘proof of concept’ and expect you’ll bring customers in, and move product.

If you’re a brand that’s still figuring things out, whether it’s around the best packaging, hero flavors, or swapping raw materials in a reformulation, it’s best to experiment on your commerce platforms. The product movement cycle tends to be quicker, and your consumers may be more generous with feedback.

Reversing course after you’ve been greenlighted in a variety of retailers is much more difficult, particularly when category resets happen at narrowly defined times of the year. As a brand, you’ll want to put your best foot forward when you get authorized by a key retail account, which can become a big chunk of business. Additionally, the added layer of distributors – who often are the traditional partners to get into retail, do not always easily facilitate change.

Stephanie Chin Yudowitch is cofounder of SnackMagic, a B2BC distribution channel that stands for product discovery. The company recently launched CPGPulse, a first-party data platform aimed at strengthening transparency and data accessibility for growing CPG brands.